omaha nebraska vehicle sales tax

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The Nebraska state sales and use tax rate is 55 055.

Car Sales Tax In Nebraska Getjerry Com

This is the total of state county and city sales tax rates.

. Greater Omaha Chamber of Commerce UNO. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Speak Victory Over Your Life Scripture.

There are no changes to local sales and use tax rates that are effective July 1 2022. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660. Nebraska has a 55 statewide sales tax rate but also has 295. Plattsmouth NE Sales Tax Rate.

Omaha Ne Sales Tax Calculator. Restaurants In Matthews Nc That Deliver. The current total local sales tax rate in Omaha NE is 7000.

For vehicles that are being rented or leased see see taxation of leases and rentals. Did South Dakota v. The exception to this is a vehicle that is currently titled in the name of the purchasers parentguardian or.

Services are generally taxed at the location where the service is provided to the customer. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. Wayfair Inc affect Nebraska.

This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. Refer to Sales Tax Regulation 1-006 Retail Sale or Sale at Retail and Local Sales and Use Tax Regulation 9-007 Cities Change or Alteration of City Boundaries. Nebraskas motor vehicle tax and fee system was implemented in 1998.

Essex Ct Pizza Restaurants. Deliveries into another state are not subject to Nebraska sales tax. Sweet Life Quotes Images.

Which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser. This example vehicle is a passenger truck registered in Omaha purchased for 33585. There are no changes to local sales and use tax rates that are effective January 1 2022.

1500 - Registration fee for passenger and leased vehicles. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. Soldier For Life Fort Campbell.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. The Registration Fees are assessed.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. You can find more tax rates and. Campos Tax Services Edinburg Tx.

The typical state and local sales tax in Nebraska is about 7 percent Conroy said so the buyer could save 14000 on an RV costing 200000. The minimum combined 2022 sales tax rate for Omaha Nebraska is. You can find more tax rates and.

Omaha NE Sales Tax Rate. Income Tax Rate Indonesia. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Free Unlimited Searches Try Now. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The Nebraska sales tax rate is currently.

Delivery Spanish Fork Restaurants. Omaha Ne Sales Tax Calculator. Nebraska has a 55 statewide sales tax rate but also has 295.

What is the sales tax rate in Omaha Nebraska. Registering a new 2020 Ford F-150 XL in Omaha. Groceries are exempt from the Nebraska sales tax.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The minimum combined 2022 sales tax rate for Omaha Nebraska is. The County sales tax rate is.

In nebraska the sales tax due is reduced if your vehicle purchase is credited with a trade. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. JA McCoy CPA PC.

Used Nissan Maxima For Sale In Omaha Ne Edmunds 25998 58K mi. Opry Mills Breakfast Restaurants. The December 2020 total local sales tax rate was also 7000.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. The Nebraska state sales and use tax rate is 55 055. Groceries are exempt from the Omaha and Nebraska state sales taxes.

You can find these fees further down on the page. Before that citizens paid a state property tax levied annually at registration time. The Omaha sales tax rate is.

Omaha collects a 15 local sales tax the. The MSRP on a vehicle is set by the manufacturer and can never be changed. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. Ad Get Nebraska Tax Rate By Zip.

Latest Information On Dmv Services Nebraska Department Of Motor Vehicles

Gulf Golf Gulf Racing Volkswagen Vw Rabbit

Contact Us Nebraska Department Of Revenue

Contact Us Nebraska Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/HRZQ5VH2HBFLJBAT4WG6ICF324.jpg)

Nebraska Tax Collections Surge Past Expectations In May

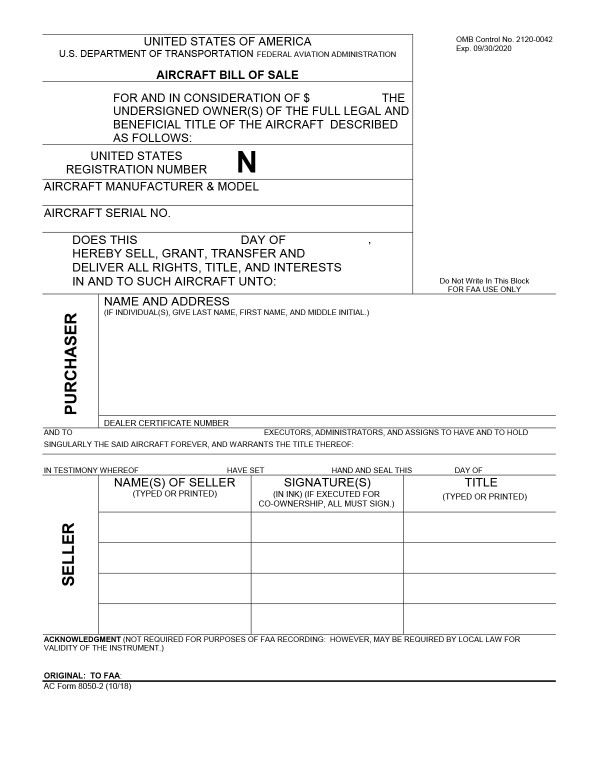

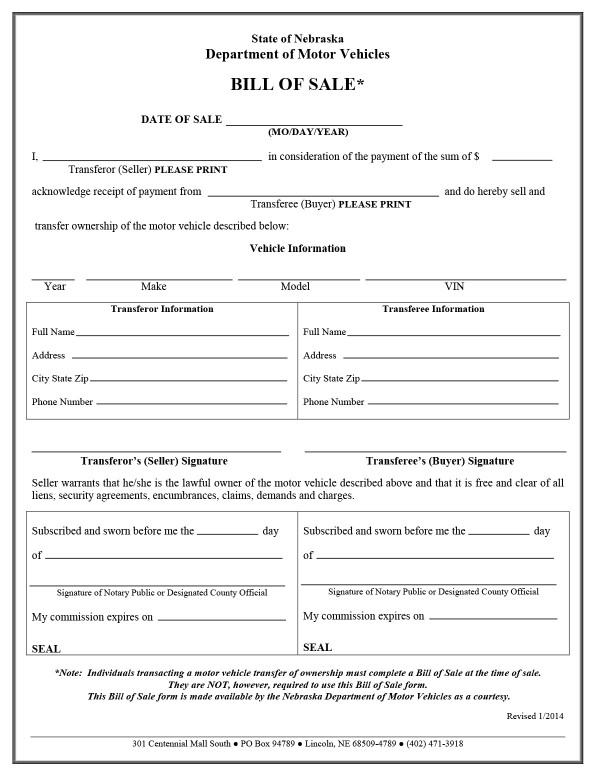

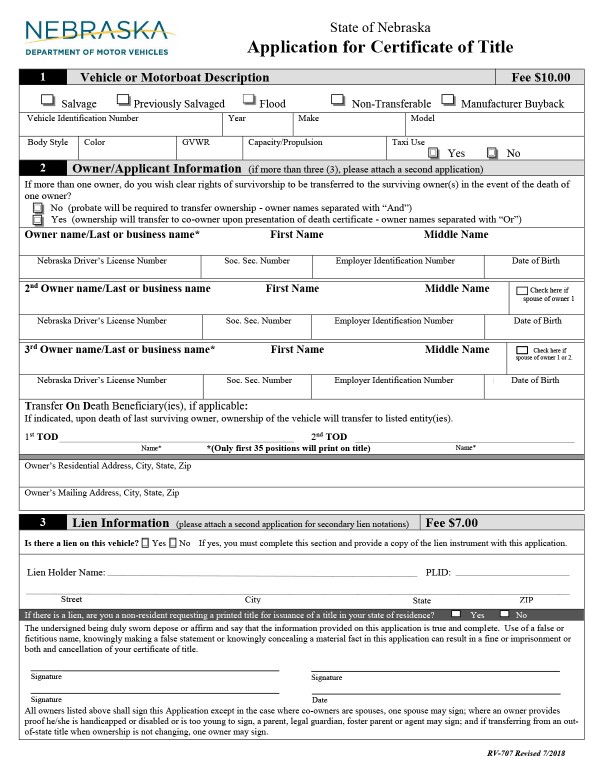

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Sales Tax On Cars And Vehicles In Nebraska

/cloudfront-us-east-1.images.arcpublishing.com/gray/HRZQ5VH2HBFLJBAT4WG6ICF324.jpg)

Nebraska Tax Collections Surge Past Expectations In May

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Welcome To Nebraska Nebraska State Signs Life Is Good

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Making Cents Why Nebraska Should Modernize The Sales Tax Pt 1

Nebraska Sales Tax Small Business Guide Truic

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

All About Bills Of Sale In Nebraska The Forms And Facts You Need